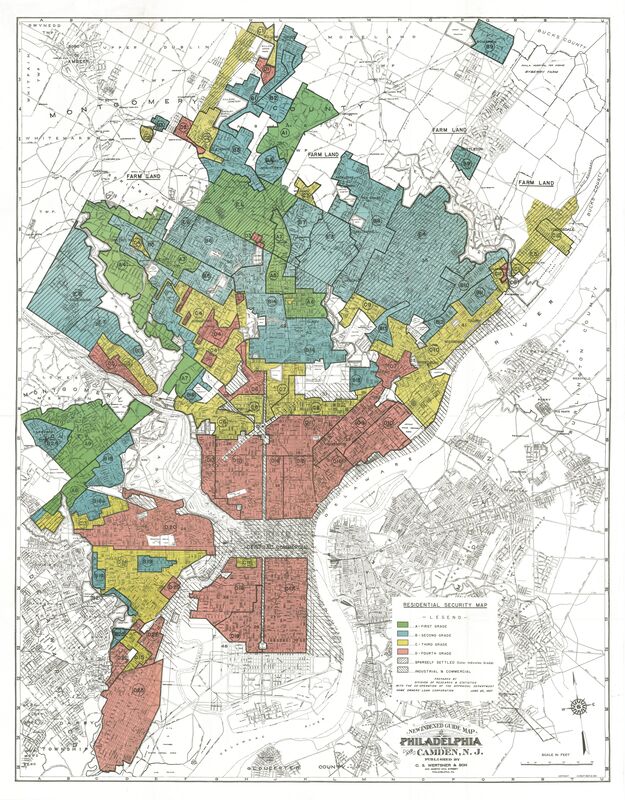

What are down payment assistance programs? Down payment programs help homebuyers afford their home by providing additional funds to pay down the loan, cover closing fees, or buy down the interest rate. These programs are offered by local, state, and private agencies. Some employers also offer assistance to employees seeking to purchase a home. There is no “one size fits all” assistance program, from determining eligibility to dispersing funds, most programs have unique processes and procedures. Funds are limited for most programs, which forces some to close for a temporary period each year. AHCOPA’s counselors will help you navigate the ever-changing options. Why do down payment assistance programs exist?Since there are a variety of down payment assistance programs, their objectives also vary. Some are looking to incentivize people to remain in a certain locale, such as employers who wish to retain employees. Many of them aim to combat inequality and eliminate the racial wealth gap. Some of them are legally mandated as restitution for communities where banks have practiced extensive redlining.

There is a growing federal interest in down payment assistance. In October 2023, the Biden administration proposed a variety of actions to bolster homeownership nationwide. Two separate down payment programs are part of that initiative, one for $10 billion and the other for $100 million. The larger fund aims to help prospective buyers whose parents do not own homes. The $100 million fund is allocated for first-generation homebuyers. Eligibility & RequirementsDown payment assistance programs consider a range of factors, such as credit scores, occupation, financial counseling, occupancy, and location. These programs usually have a financial counseling/housing counseling requirement which we fulfill with AHCOPA’s first-time homebuyer program. Several down payment assistance programs act as a lien or secondary loan. When structured this way, they are often set to be forgiven after certain requirements have been met, such as length of occupancy. This means that if you move out or sell the home before the set requirements are met, you will have to pay back the awarded funds. Some lenders offer funds with fewer restrictions. However, you will need to use their mortgage product to access their down payment assistance funds. Bank funds can be “layered” or combined with other down payment assistance funds. A counselor will suggest you review more than one bank's offer to find the best option for you. AHCOPA housing counselors are experts in identifying the ideal set of down payment assistance programs that you may qualify for and combine! Popular down payment assistance programs in Philadelphia

This grant acts as a lien against the property and is forgiven after 15 years. To learn more about the Philly First Home grant visit PHDC’s website. First-time Homeowners Match Saving Program Managed by ACHIEVEability and also known as the Lubert Individual Development Account program. Prospective homeowners may triple their down payment savings with this savings matching program! For example, a savings contribution of $2,000 will be matched with $4,000, for a total savings of $6,000. Some requirements include:

First Front Door Managed by FHLBank Pittsburgh. Prospective first-time homeowners may receive up to $15,000. The Keys to Equity fund aims to serve minority and first-generation first-time homebuyers and may provide up to $20,000. Some of the requirements include:

Keystone Forgivable in Ten Years Loan Program (K-FIT) Managed by Pennsylvania Housing Finance Agency, PHFA. Prospective homeowners can receive up to 5% of the purchase price in assistance. PHFA does not set a dollar amount limit on the assistance funds received, instead, they set a maximum purchase price/appraised value and assistance can be up to 5% of that price. There is a minimum amount of assistance, set at $500. Some of the requirements include:

For more down payment assistance programs, check out our resources page! To get started on your homeownership journey, the first step is to take a first-time homeownership workshop, find our next available workshop by clicking the button below. Naara SilvaNaara works with AHCOPA as an AmeriCorps VISTA through Housing Action Illinois.

0 Comments

Leave a Reply. |

215-765-1221

Contact Us

RSS Feed

RSS Feed